Individual Retirement Accounts (IRA) are used by taxpayers as valuable investment tools for retirement planning. When considering options for retirement investments, just like most financial options, many factors come into play.

A taxpayer’s traditional IRA assets appreciate on a tax-deferred basis, are discretionary- but set to a maximum yearly contribution- and, depending on the individual’s gross income, may be tax-deductible.

Only when the money is withdrawn after retirement as distributions, are the assets taxed.

As you may have heard, another option for taxpayers to contribute to a retirement account is the fairly similar Roth IRA. In 1998, fiscal conservative senator William Roth, Jr. created the Roth IRA account that is not taxed under certain conditions. Simply put, the difference is sewn in the tax breaks. Other accounts grant a tax deduction for assets placed into the plan, while the Roth IRA grants a tax break on the withdrawals made during retirement. Its attractiveness is found in its flexibility.

As popular as is this option is, married filers earning greater than $191,000, and single filers earning greater than $129,000 in 2014 are booted from direct contribution eligibility– but not to be discouraged. If you’re in a higher tax bracket, the indirect back door route to a Roth IRA, as used by many, may be your answer.

As a taxpayer, if you are not already contributing to a traditional IRA, opening one and quickly rolling it over to a Roth IRA will more than likely cost nothing in tax. This plan is simple and the benefits are just as sweet.

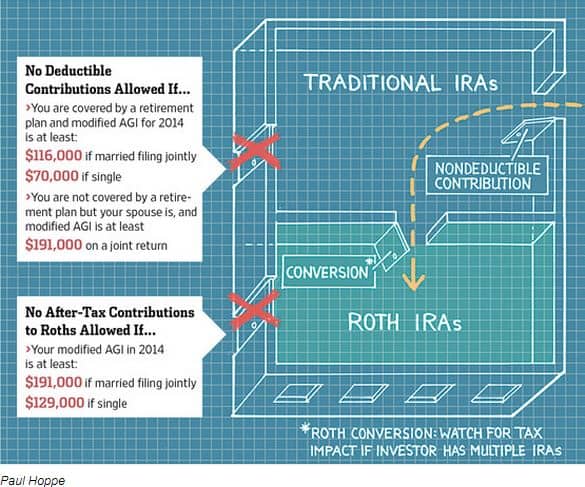

Check out this illustration by Paul Hoppe from the Wall Street Journal to portray the possibilities for each tax bracket. Note the message at the bottom explaining a tax trap for those individuals who already contribute to traditional IRA’s.

If this is an option you’d like to look into or learn more about for your specific financial situation, let’s talk.

The Maddox Thomson team is always here to help.

Call or email us at [email protected]

March 26, 2014

Contributing to an IRA: Roth’s boot in the door

Individual Retirement Accounts (IRA) are used by taxpayers as valuable investment tools for retirement planning. When considering options for retirement investments, just like most financial options, many factors come into play.

A taxpayer’s traditional IRA assets appreciate on a tax-deferred basis, are discretionary- but set to a maximum yearly contribution- and, depending on the individual’s gross income, may be tax-deductible.

Only when the money is withdrawn after retirement as distributions, are the assets taxed.

As you may have heard, another option for taxpayers to contribute to a retirement account is the fairly similar Roth IRA. In 1998, fiscal conservative senator William Roth, Jr. created the Roth IRA account that is not taxed under certain conditions. Simply put, the difference is sewn in the tax breaks. Other accounts grant a tax deduction for assets placed into the plan, while the Roth IRA grants a tax break on the withdrawals made during retirement. Its attractiveness is found in its flexibility.

As popular as is this option is, married filers earning greater than $191,000, and single filers earning greater than $129,000 in 2014 are booted from direct contribution eligibility– but not to be discouraged. If you’re in a higher tax bracket, the indirect back door route to a Roth IRA, as used by many, may be your answer.

As a taxpayer, if you are not already contributing to a traditional IRA, opening one and quickly rolling it over to a Roth IRA will more than likely cost nothing in tax. This plan is simple and the benefits are just as sweet.

Check out this illustration by Paul Hoppe from the Wall Street Journal to portray the possibilities for each tax bracket. Note the message at the bottom explaining a tax trap for those individuals who already contribute to traditional IRA’s.

If this is an option you’d like to look into or learn more about for your specific financial situation, let’s talk.

The Maddox Thomson team is always here to help.

Call or email us at [email protected]

Featured articles

ChatGPT vs The Accounting World: A Revolution in Efficiency

Tax Block Changes for 2024

Deferred expansion of 1099K reporting for electronic payments like Venmo or Zelle

Tax Benefits of living in the great state of Texas

Texas Size Property Tax Cut Proposal

Celebrating a Fantastic 2022

Related articles

Texas Size Property Tax Cut Proposal

Citizenship for MTA’s Own Chi Le

2022 Annual Inflation Adjustments for Numerous Tax Provisions

Tax Changes Proposed in President Biden’s American Families Plan

Tax Provisions in the American Rescue Plan Act of 2021 (Part Two)

Tax Provisions in the American Rescue Plan Act of 2021 (Part One)

Important Update: Tax Filing Extension for Texas Residents

President-Elect Joe Biden’s Tax Agenda

Order Up! IRS Issues Final Regulations on the Deduction of Business Meals and Entertainment

Tax Tips for Trying Times

Tax Day 2020 is Fast Approaching … Are You Up to Speed?

New Developments Around the Paycheck Protection Program: The IRS Makes Deductions Decision